Once upon a time there was a tech startup in the Valley. Its steady hum of growth turned into a loud buzz in the press. Investors poured in money every six months at a 3X valuation. Its employees were exhilarated and talked of “exercising options,” “going all in,” and “getting a good tax treatment.” One employee withdrew his life savings — tens of thousands of dollars — to exercise the stock he had in the startup.

The company’s plummet was as fast as its ascent. There were bad economics under the hood and it went belly up. The leadership only managed to sell part of the company in a fire sale. The employee who was convinced his company was worth spending his life savings was left with nothing. Instead of a winning lotto ticket, he got a pink slip.

Horror stories like these made Amplitude Co-founder and CEO Spenser Skates rewire equity compensation at his mobile analytics startup nearly three years ago. While at Y Combinator, he heard tales of people signing offers they didn’t understand and read all the complaints from bitter employees on Hacker News. His network told him that equity compensation was not an area to innovate, but Skates realized how badly it was broken and wanted better for his team. He was sure it was not only the right thing to do, but that it’d also help Amplitude better retain and recruit talented people. Since then, a handful of other companies have started to follow suit.

In this interview, Skates takes an expansive look at why standard equity compensation provisions fall short and the tweaks that will better suit your company and employees. He also shares the guiding principles he uses at Amplitude to educate and update his team on the value of their equity. For easy adoption, Skates provides sample contracts and charts so others can be as transparent with their employees from the beginning.

Transparency isn’t just All Hands meetings or shared OKRs. It starts with the contract you make with your people and ensuring they know what it means.

Why You Must Extend Your Exercise Window

According to Skates, the 90-day option exercise window is one of the biggest “gotchas” in the startup world. “Yet, when I asked around, many companies — even ones who are known for experimenting with equity comp — shy away from changing it,” says Skates. “I had heard that this well-heeled, consumer tech startup had done it, but its former lawyer admitted to me that he’d never seen it before and doesn’t recommend it. I even asked two major law firms that work with many startups in the Valley, but they said they couldn’t do it.”

It wasn’t until Skates met with the team at Goodwin Procter that he found attorneys that were willing to dig in with him. “I learned that the reason options exist is essentially to avoid taxes. If companies give employees stock outright, they need to pay taxes on it. But if they’re given the option to buy shares at a specific price, there’s nothing to tax until they buy them,” says Skates. “Now there are other structures such as Restricted Stock Units (RSUs), but as far as I know, the original reason equity compensation is in the form of options is to get around taxes. Because if you were to design this system from the ground up, you’d likely just give the shares outright.”

Then there’s the 90-day window provision. “Almost all startups give 90 days to employees, once they leave or are terminated, to exercise their vested stock options. If they don’t, they lose them,” says Skates. “If they do, they must pay the exercise price of the shares as well as their tax liability. In other words, the everyday employee must come up with a substantial amount of cash within 90 days of leaving a company, likely while they are trying to find or start a new job.”

.jpg)

For Skates, comparing equity to salary really reveals its shortcomings as payment for employee performance and loyalty. “If you ask the people who write up these provisions, they’ll tell you that the 90-day window is a mechanism for the company to recover equity. But why would you grant it in the first place, if you weren’t truly willing to give it away? It’s like saying, let me give you this cash and then we’ll put in a mechanism to recover your salary if you leave,” says Skates. “No. If you worked the time, you earned your right to all of your compensation: money and equity.”

For all these reasons, Amplitude has changed its post-termination option exercise window from the standard 90 days to ten years for all employees, regardless of their tenure. “What it means in practice is that employees own their vested stock options even after they leave and can exercise them up to a decade after they depart. Technically it meant that, instead of clawing back employees’ expired Incentive Stock Options (ISOs) 90 days after they leave, we convert them to Non-qualified Stock Options (NSOs), which allows former employees to own them. The upside is that they can take time to exercise them over ten years; the downside is that they don’t have the preferential tax treatment of an ISO. It’s not perfect, but it’s big step in the right direction.”

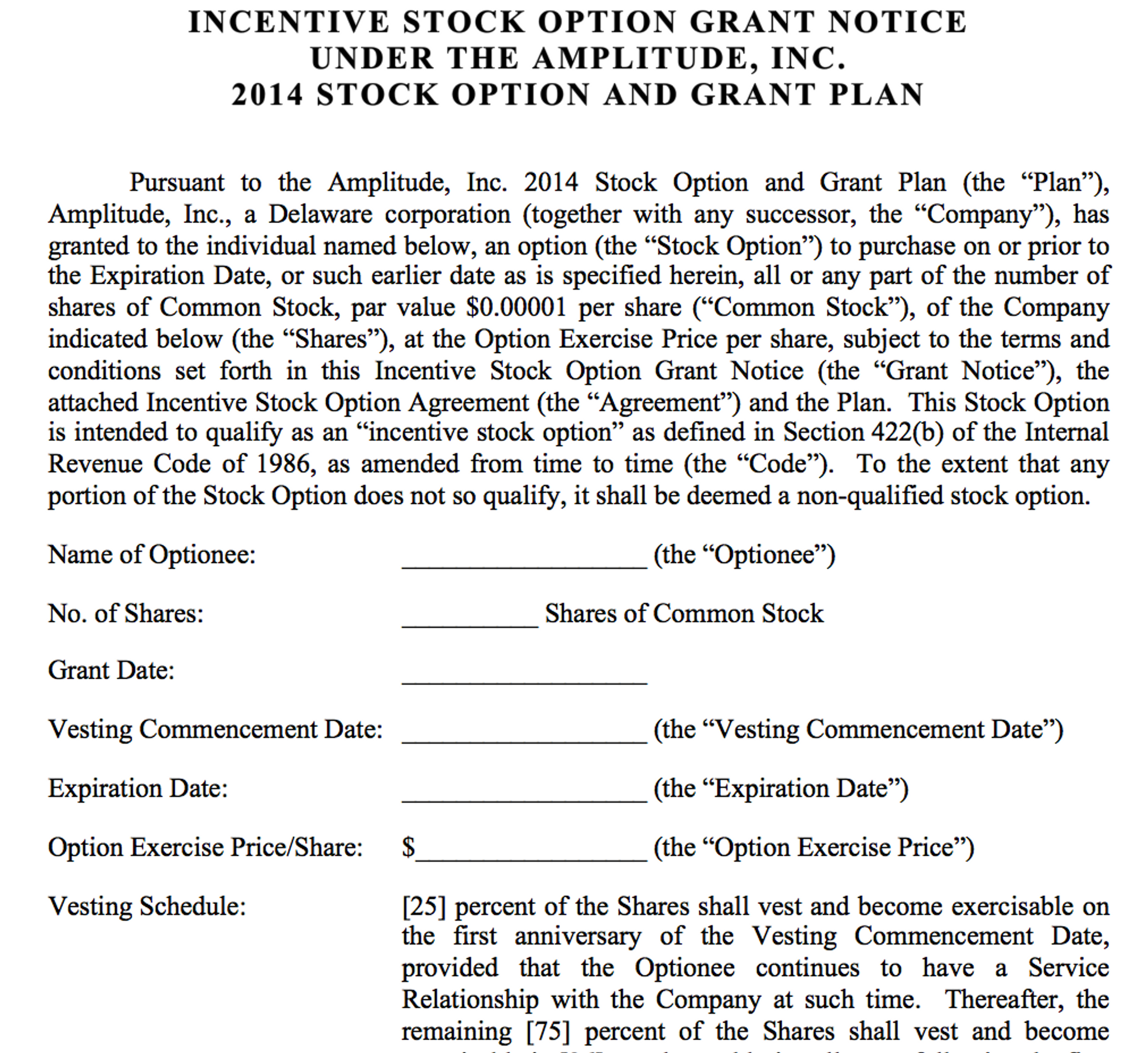

Skates and the team at Amplitude have open-sourced a template of its ISO Agreement with employees so that other startups can use them, after consulting their lawyer. “It’s not fair to employees — especially a 22-year-old engineer in his first job — to be pushed into making what is likely one of the biggest financial decisions to date over three months,” says Skates. “We don’t think that should be a special consideration for just Amplitude employees. Given how common granting equity is at startups, this reform is less adding a novel perk and more taking a stance on sound startup culture and living the values of your company.”

How is it that we live in the innovation epicenter and have ‘disrupted’ everything except the way we compensate and give ownership to the people who build with us?

How to Make Equity Education Ongoing from Onboarding

The new employee experience is riddled with paperwork, let alone the often stressful adjustment to a new place and role, leaving the process of researching tax implications or concentration risk all the more daunting.

One of Skates’ other goals around equity compensation is to bring transparency to what granted equity can look like to each employee who joins Amplitude. That entails providing new hires with detailed information about what the equity being granted to them signifies. “We want you to be as clear with your equity as you are with your salary. Beyond that, we don’t want you to start with us and feel as if you’ll need to fend for yourself when it comes to your compensation,” says Skates. “I know how much time it takes to digest this information — I’d rather the team focus on the work at hand rather than spend a week figuring out how to optimize their investment decision in the company.”

Don’t make it more of a challenge for employees by being passive or neutral. “It’s very typical for companies to say that they can’t even tell you how many shares outstanding we have. I’m sorry but that’s total crap. It’s not only not true, but not helpful. What’s most important is the percentage of the company a share represents,” says Skates. “Companies are also skittish about saying how much a share is worth because they’ve been warned it constitutes as a representation that employees can hold them to down the line.”

Companies are frightened to shine a light on equity compensation, so they keep employees in the dark. That’s no way to build a company.

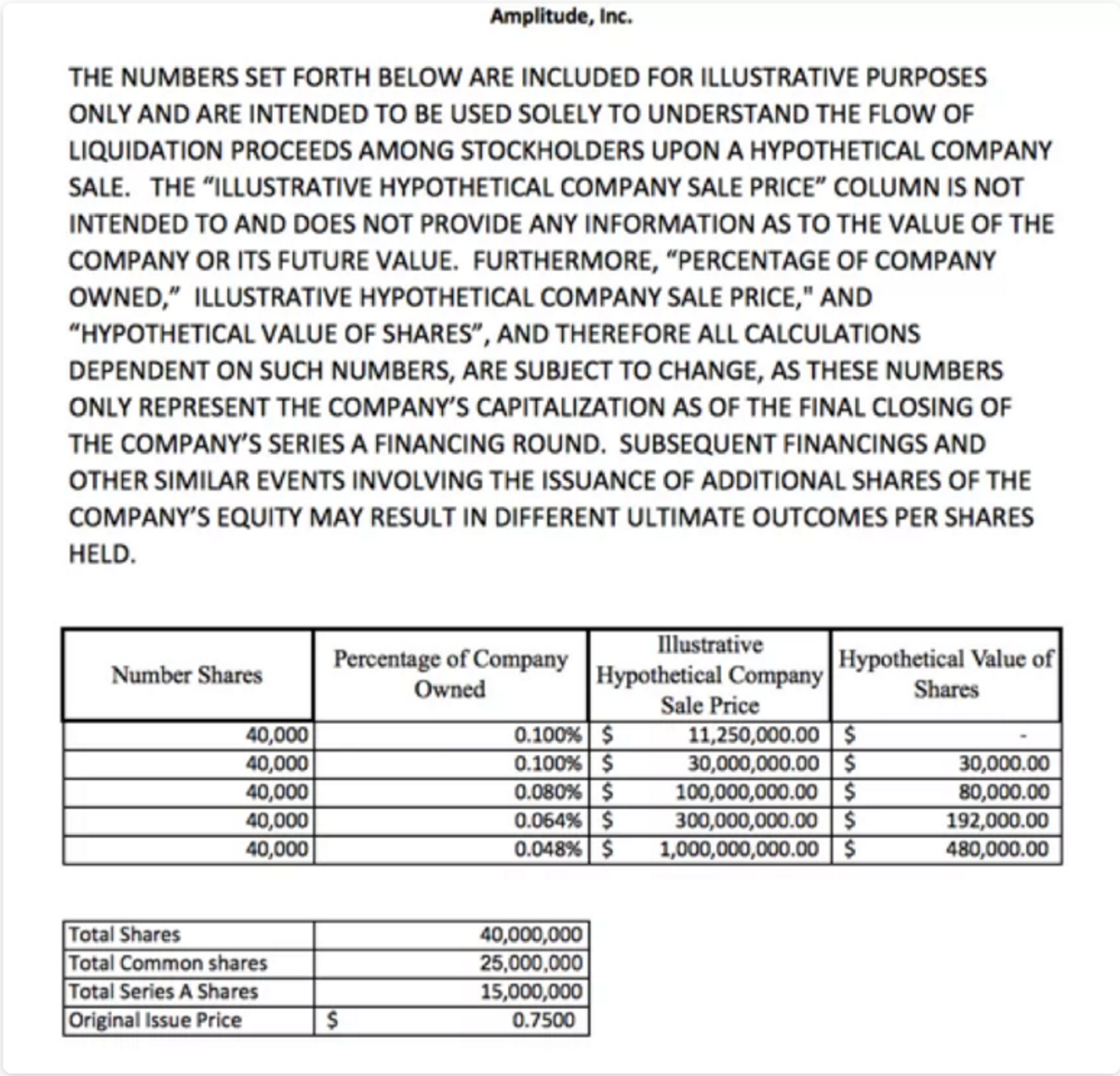

One of the first steps that Skates took was to create an employee stock summary chart to help his people scenario-plan by outlining hypothetical scenarios with potential dilution included. “We walk through a range of possibilities to illustrate the spectrum of outcomes. I also acknowledge that if we sell at less than or equal to our liquidation, then the equity is worth nothing,” says Skates. “When you go through the scenarios with employees, it grounds the visions they have playing out in their heads. Even if it’s a rough estimation with a big variance, it’s better to show something than nothing at all.”

Here are the five main scenarios listed in the chart:

- Scenario One: The company is worth nothing.

- Scenario Two: The company is worth its valuation at its last round of funding.

- Scenario Three: The company does well.

- Scenario Four: The company does outstanding.

- Scenario Five: The company fully achieves its long-term vision.

At Amplitude, once candidates are given an offer, they also receive this customized chart on their equity compensation. “We don’t mention our stance toward equity during the interview process because we want candidates to be interested first and foremost in the company, the team and their place on it. Sharing our position on equity should elevate their existing enthusiasm,” says Skates. “When we share the chart, we want it to be an active display of our commitment to transparency. Especially if it’s their first startup job, the hiring manager or I explain the journey we took to extend the exercise window. It’s important they know the lengths we’ll go for our team.”

On the chart there’s a clause that says that all calculations are subject to change and only represent the company’s capitalization as of the final closing of its last financing round. “This is necessary legalese that an attorney should help you draft. What’s important is that it states that the company’s valuation and percent of ownership will change in the future. That’s why we give people an update to their charts about once a year, especially if we raise another round of capital,” says Skates. “It’s important that they understand that I know these numbers will change but not where they’ll end up. Regardless, I want them to have some context and reference point.”

This new stance on equity compensation is about your leader. Once decided, it’s easy to implement. It’s a one-time cost from the right lawyer and you’re set.

What’s Next With Equity Compensation

Skates enacted these changes with equity compensation almost three years ago. While he notes a strong retention of his team and an uptick in referrals, (fortunately) not enough people have left to fully test the full impact on departed employees. “It’s still an experiment, but one where we believe the investment will be as worthwhile in the long-term as it has been to date,” says Skates. “Until we hit the end of a 10-year window, we’ll have to measure our approach by if employees vote with their feet. And more broadly, if tech adopts these changes.”

For now, Skates is satisfied with helping lead the evolution of equity compensation with the two changes at Amplitude, but will also monitor any new adoption or innovations in this arena at other technology companies. “Coinbase, Pinterest and a handful of other companies have extended their exercise windows for employees, but relatively few of them as far into the future as a decade,” says Skates. “What I love seeing is new experimentation happen. Groupon’s founder Andrew Mason, who has a new startup Detour, has spearheaded an interesting model that I can best describe as socialist equity. In short, half your equity is yours and half is distributed to the rest of your team. In the case of an acquisition, everyone gets the minimum threshold of equity.”

Skates admits that Mason rightfully draws from his political capital from his Groupon pedigree to run bold experiments with equity compensation, but that shouldn’t dissuade others from stepping up to bat. “Triggers, which help guarantee granted equity in the event of an acquisition, is an area that could use reform. Before an acquisition happens, there are founders, investors and advisors around the table,” says Skates. “I believe there should be an active advocate for employees. In the best cases, it’s the founder. But if a contentious issue arises and someone needs to take a hit, too many times it’s the employees. People shy away from changing triggers because it reduces your negotiating power with the buyer. But that’s at the expense of protecting the equity of your employees, who helped build the company you’re selling.”

Bringing clarity to employee equity is simple compared to good management, which is a f*cking hard thing to do. Be a better leader and pluck the low hanging fruit.

Skates has analyzed his share of complex systems, as a former algorithmic trader and bioengineer at MIT. When the quagmire that is employee equity compensation puzzled him, even after numerous meetings with attorneys, he knew it’d be a mess for his employees. Forward-thinking startups should benefit from his groundwork to make two simple fixes. Extend the exercise window from the standard 90 days to 10 years for all employees and provide each new hire with details about what their granted equity means in different scenarios. Skates has open-sourced templates for both, so all that’s required is a consultation with your attorney.

“Expect to raise eyebrows, whether they belong to your lawyers, investors or fellow founders. But I’d prefer that to the slumped shoulders of my employees. Your approach to equity compensation determines how people enter and leave your company — and if they remain ambassadors of your brand. You can choose if they’ll hold a candle or a torch for you after they go,” says Skates. “I’d love to see this approach to employee equity evolve into the standard over the next few years and mark the good places to work. Ideally, it becomes so commonplace that startups adopt other ways to advance equity compensation. It’s the truly transformational companies that innovate throughout their organization, not just in their products.”