As the story goes, legendary Tonight Show host Johnny Carson once interviewed renowned salesman Zig Ziglar. Carson was ready to put Ziglar to the test.

“They say you’re the world’s greatest salesman,” said Carson. “How about you sell me something — say this ashtray?”

“Before I can do that,” replied Ziglar, looking at the ashtray. “I’d have to know why you want it.”

“I guess it’s well-made, it looks pretty nice, and it’s a good ashtray,” replied the talk show host.

“Alright,” responded Ziglar, “but you’ll have to tell me what you think it’s worth to you.”

“I don’t know,” thought Carson, “I guess $20 would be about right.”

“Sold!” Ziglar exclaimed, smiling.

Whether this exchange is fable or fact, it unpacks a lot of what it means to price a product: from the interactive approach to the layered, fact-finding line of inquiry. For startups, pricing a product or service is a doorway you must walk through — or users might abandon you at the threshold.

Here at the Review, we’ve spotlighted several keen minds that have nimbly navigated the process of pricing for years — and have built careers and companies doing so. Instead of having you hunt for them in our archives, we’ve assembled the six most impactful actions a startup can take to get their pricing right. Our goal, as always is to help you get smart fast and apply what you’ve learned to make an immediate difference in your company or career. Or, in this case, to help you avoid buying — or selling — $20 ashtrays. Here we go!

Nail price before product. Period.

Building around price is the way forward according to Madhavan Ramanujam, a board member and partner at consultancy Simon-Kucher & Partners. At the firm, he’s managed 125+ pricing projects for companies ranging from rising startups to the Fortune 500 — and has surveyed them, among others. Here are a few findings:

- ~80% of respondents said they were under price pressure.

- ~60% even said they were in a price war.

- The top way companies planned to respond to price pressure was to release new products and services in order to survive.

- Yet 72% of these innovations did not meet their revenue or profit targets, or even failed completely.

Ramanujam asserts that new products fail for many reasons, but the root of the problem is the failure to put the customer’s willingness to pay (WTP) for a new product at the very core of product design. Most companies postpone pricing decisions until after the product is developed, hoping they’ll make money rather than knowing they will. Here’s how not to fall into that trap:

Ask someone if they like a product. Then ask them if they like it at a price point, say $20. The whole conversation changes.

In his Review article, Ramanujam calls this a willingness-to-pay talk, which about 80% of companies don’t do, according to a Simon-Kucher study. “Ask at the onset whether or not people would pay for the product you intend to develop,” Ramanujam says. “Frontloading this question is powerful because customers won’t be in the mindset of negotiating price. Instead, they’ll give you objective feedback that you can use to prioritize what you’re building.”

Weave in price sensitivity into your feature preference surveys.

Over the years, Patrick Campbell has seen startups and multinationals alike labor to perfect products only to casually raise their finger to the wind when it comes to determining their price. So he launched Price Intelligently to help SaaS companies, such as Atlassian, Hubspot and Insightly, boost revenue from and knowledge of their users, particularly through surveys.

Of course, there’s nothing more dreaded or beloved in the world of marketing than the online survey. Campbell and his company have sent over 15 million surveys, and have studied what’s worked and not worked along the way. Which brings us to our favorite tactic from Campbell, which is involves how he designs his feature preference surveys:

To start, focus surveys to test two elements — features and price sensitivity — with a relative preference methodology.

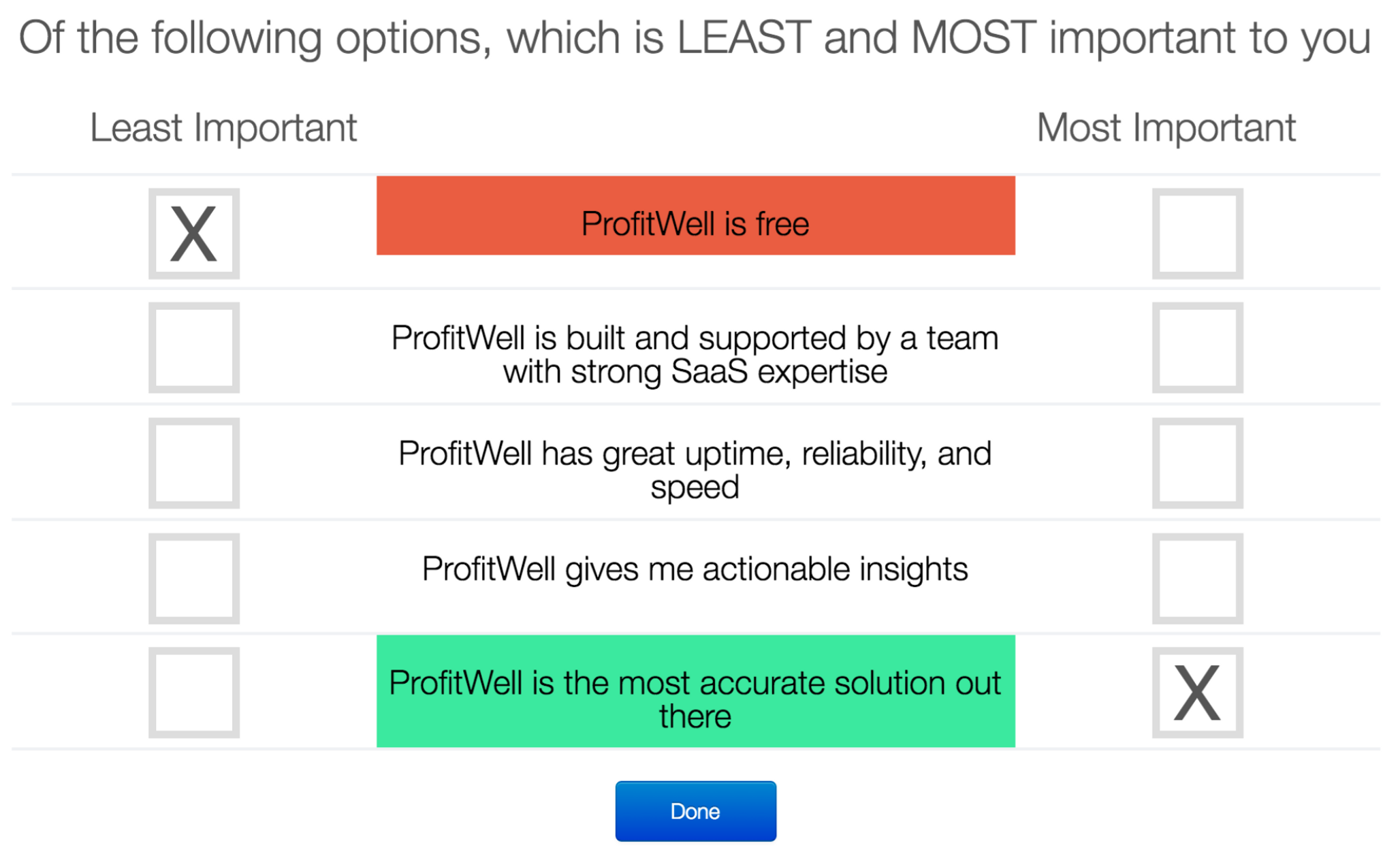

To test relative preference, list a set of features — including one that gauges price sensitivity — to evaluate and hone in on the extremes. Then, ask survey takers to identify the least and most important of the options. Here’s an example:

The beauty of this approach is that it efficiently extracts people’s preferences in a question. It falls between the multi-step or multifaceted question (which can be time-intensive and burdensome to complete) and the simple, lightweight question (which may not return the depth of response you seek). For additional pricing tactics from Campbell, read more here.

Map how your product’s price correlates to a marketing- or sales-intensive strategy.

Mark Leslie is no stranger to the Review. The Stanford Graduate School of Business lecturer and founding Chairman and CEO of Veritas software has shared his advice on the arc of company life, challenging incumbents and the sales learning curve.

Here, he offers a simple framework that can bring a go-to-market strategy into focus — one that can help startups smartly deploy limited resources when a product is first launched and a company has one chance to make a strong, first impression.

The first step in the framework? Price.

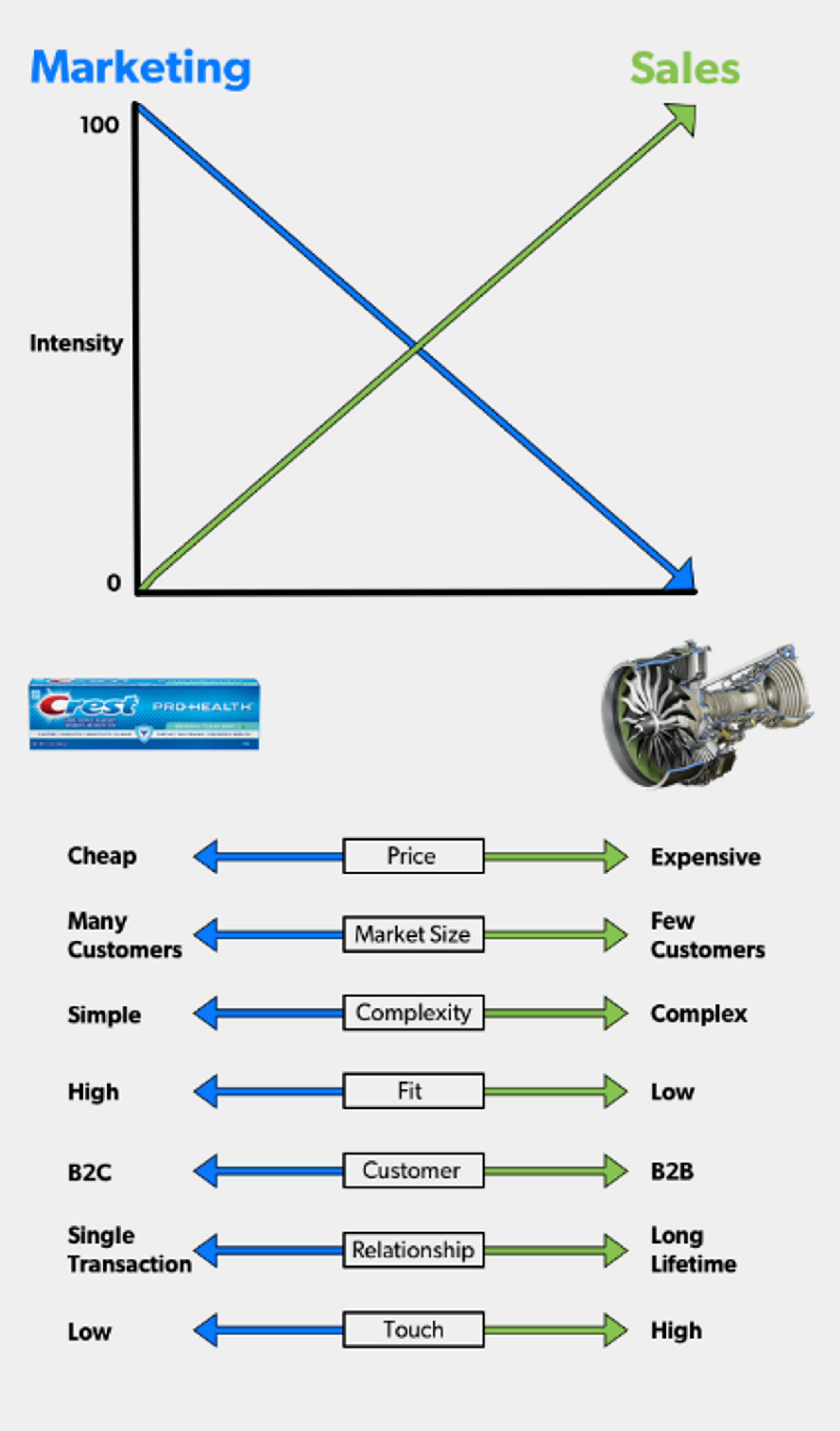

“Price is determined by how the customer values the product or service. Simply stated, it’s how much is the customer willing to pay, which is tied to the return-on-investment that the customer realizes,” says Leslie. “For example, you can’t afford to ‘sell’ a $2 tube of toothpaste. To prove it, just take the total cost of the salesman and divide it by the number of sales calls in a year. That’s why no one goes door-to-door saying, ‘Let me explain the benefits of Crest over Colgate.’ But, say you’ve got a product that costs $100,000 to build, you need to sell it for $200,000. Now you’re in a sales-intensive go-to-market strategy.”

To get started, ask yourself: “Is this a large or small economic decision for the buyer?” And see how you map along the other factors in Leslie’s framework.

Know how your product’s price impacts how and what you ship.

Before becoming an investor, Jocelyn Goldfein led engineering teams at Facebook and VMWare. She shipped a lot of software — at companies ranging from three to 10,000+ employees. Over her career, she’s built software that’s been given away for free and sold for $50M license fees — and just about every price point in between. In her Review article she focuses mainly on how to structure releases, but observes astutely why a product’s price will determine and influence how your team develops and ships software.

If you sell software at a high price tag, chances are you are selling to businesses that are buying your software based on their need. The more expensive your software is, the more mission critical it is for your customers, and the more likely you have to optimize for reliability, functionality and a predictable schedule.

But as the price of software goes down — from millions to thousands, to hundreds, to freemium and free — your market goes higher volume and involves smaller businesses or consumers. For these products, schedules can be less important since people will generally accept your latest enhancements whenever they materialize. The influence of a single customer is small, so you might deprioritize a niche platform or bugs that affect only a few people.

As a rule of thumb, expensive software means predictability is key while shipping. Customers need your product. If you have a lower (or no) price tag, focus on UX. Users who don’t need your product have to want it.

Be selective about incentives and discounts.

Amazon famously drove up its purchase volume by offering free shipping for all orders over $25 (after an increase to $35 and back down to $25 in 2017). Free shipping is an attractive incentive because it appeals to anyone who is getting something mailed to them. But what’s an equivalent offer for startups that don’t offer physical products — and where free shipping makes no sense?

When Alex Rampell was the CEO of alternative payment startup TrialPay, he observed and tested a number of different experiments around incentives and discounts, and found three strategies to be particularly effective:

- Never ASK people for a “coupon” code. And get rid of your “coupon” field in your checkout flow. You’ll lose customers and revenue if you ask them to go hunting on Google for coupon codes.

- Contact information has long-term value if you can get it. It’s worth turning off some users in order to get more data (e.g., email addresses) for other customers that can help you segment them going forward.

- If you don’t have anything to offer as a bonus, find a complementary partner that you can work with to offer something unique. Rampell found that companies would partner and readily give away gift certificates (if well-qualified, like after a higher dollar purchase) in exchange for new customers. Checkout rates increased by 15% to 25%.

If they think they can find a discount opportunity that’s just a click away, they will go hunting at your peril. Playing into this game doesn’t just dilute your income with unnecessary discounts. It sends people out of your checkout flow where they might get distracted and abandon the process altogether.

When you ask your user for a coupon code, you’re basically giving them an IQ test asking 'Are you dumb enough to pay full price or would you rather pay less?'

All that said, discounts aren’t inherently bad. They can be incredibly effective if you position them correctly. Rampell shares how in the full article here.

Design A/B tests on price with international users in mind.

When Gixo co-founder Selina Tobaccowala joined SurveyMonkey in 2009, 85% of its business was done in English. It was solidly a domestic company making slow inroads overseas. A little over five years later, the company was supporting 17 different languages and 28 currencies.

It’s challenging enough to come up with one price for a product, let alone for several global markets. The truth is payments and pricing are vastly different around the world. You have to do a lot of customization as you start thinking about conversion rates and international conversion funnels. And for technology companies with global aspirations, that hurdle is an inevitability.

One key piece of advice from Tobaccowala is to design A/B tests so that pricing and packages will always be the same for the same users. Most A/B testing platforms are cookie-based. This is a problem internationally where more people access websites from multiple devices. This means many of them will see multiple versions of your pricing page — which could send harmful mixed messages — at a time when you’re just building your brand in a new market.

The solution that Tobaccowala proposes is to be consistent and persistent on the user level instead of the cookie level. This is something to consider doing if you're going to invest in building price experiments anyway, but especially important for international users. For more on how Tobaccowala helped SurveyMonkey crack pricing and international markets, continue here.

This is far from the end of the Review's wisdom on pricing, check out the full articles referenced above as well as others focused on pricing and channel partner conflict, navigating the freemium model and revamping pricing.

Art by John Lamb/Getty Images Plus/Getty Images.